Indian Americans should not forget to add Foreign Bank and Financial Account Report (FBAR) while they file the tax return. Since US is cracking its whip on foreign banks and its accounts, filing Foreign Bank and Financial Account Report has become mandatory. If you are a US citizen or resident and had an amount of $ 10,000 at anytime during the year, you must ensure that FBAR is filed before June 30, 2012 as that’s the deadline.

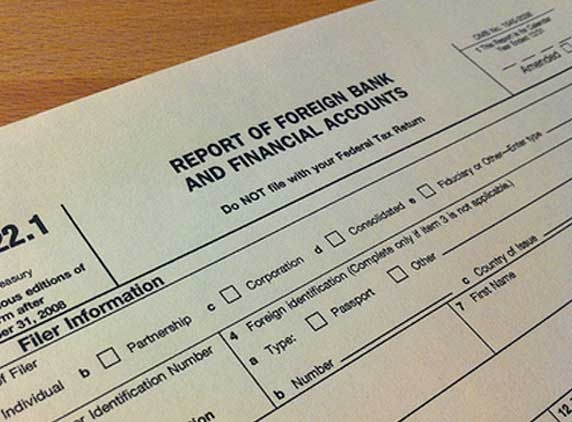

In addition to the tax return, this FBAR is filed. This should be filed in the TDF form. The main purpose of FBAR was to find out the information on foreign bank accounts. This rule can be found in Bank Secrecy Act of 1970.

Even if you have no income, you must still file FBAR as you have a foreign bank account. In case there’s no foreign bank account, then no worries.

In case you don’t file FBAR, you will be subjected to civil penalties that may extend up to $1,00,000 or 50 per cent of the account balance. Sometimes, you may even get the criminal penalty of $2,50,000 or 5 years imprisonment.

So, friends don’t delay. File your FBAR right away!

(Phani)