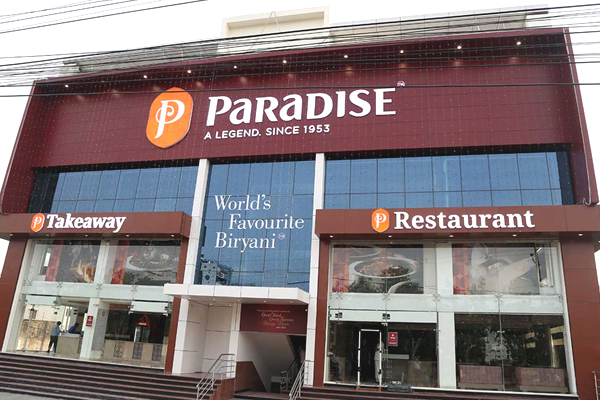

The Telangana tax officials, can collect VAT from Paradise Hotel, when it sells biryani, but not when it transfers its value of the shares i.e. equity into a new company, said the Hyderabad High Court.

The HC further stated that under the Telangana VAT Act, 2005, the sale of goods is taxable, but the sale of business as a whole is not taxable. The famous biryani hotel, till date was run as a partnership firm under the name “Ms Paradise Food Court” but it recently changed itself into a new entity called “Paradise Food Court Private Ltd”. The previous management too will have a equity in the new company, that may include new investors. The tax officials, imposed a VAT on this equity transfer also, when the old management was transferring equity in the new company.

The hotel then challenged the tax sleuths in the High Court. The division bench comprising Justice V Ramasubramanian and Justice J Uma Devi pronounced in its judgment that the regular business of the firm falls under VAT purview, but its stake sale or sale of business as a whole, does not come under it.

In May 2014, the petitioner, a partnership firm, said the court that it had entered into Business Transfer Agreement with a company leading to the creation of Paradise Food Court Private Limited. Furthermore, it also agreed and undertook to transfer its entire business as an ongoing concern, in consideration of equity shares and mandatorily convertible preference shares being allotted to the partners of the petitioner firm.

The tax on sale of fixed assets, sale of goodwill and other income, was imposed by the Assistant Commissioner of Commercial Taxes, in view of transfer of business on the ground that there was no provision in the Telangana VAT Act 2005, which provides such exemptions.

“As a matter of rule, we would not entertain writ petitions under Article 226 as against the orders of assessment passed under any tax statute, since any person affected by an order of assessment, will have an effective statutory alternative remedy of appeal,” the bench said. But there are two exceptions to this rule. “We will intervene when the authorities are acting without jurisdiction and when they are violating principles of natural justice”. In the present case, they acted without jurisdiction because the Act did not confer any powers on them to tax the transfer of a business. The petitioner challenged the tax order on both grounds of lack of jurisdiction and violation of principles of natural justice, the bench noted.

The bench referring to the provisions under the VAT Act 2005, it held that “the transfer of business as a whole is not included in the charging provision. It is only by virtue of a logic that every transfer of business would also include a sale of goods of the business that the charging provision is sought to be invoked.”

SUPRAJA