Two Indian origin businessmen in Leicester, UK, are facing money laundering charges. Two Leicester-based businessmen of Indian origin in the UK are facing money-laundering charges, after the duo transferred 4.6 million pounds in cash to India and Dubai. The accused Harish Patel (55) and Ravindra Patel (50) have denied the charges against them.

Fifty-five-year-old Harish Patel and 50-year old Ravindra Patel transferred 4.6 million pounds in cash to India and Dubai. But the two Patels have denied the charges against them.

The Leicester Crown Court, which is hearing the case, was on Monday shown CCTV footage of Ravindra taking the money into a local branch of the Bank of Baroda in a suitcase on wheels and with a rucksack stuffed with cash on his back.

According to reports, Harish allegedly used his legitimate family-run electrical company as a front for transferring the money to India and Dubai.

Luke Blackburn, prosecuting lawyer, said together “they acted as money launderers over the course of five months, involving millions of pounds.”

“It was transferred in money transfers and it came from crime, which these two men knew or at least suspected. These two defendants worked hard to move money abroad in huge quantities, treating it like a business and taking a cut,” the lawyer said.

It was also added that the source of the money was not clear. It was also not clear as to what happened after it was converted into either American dollars or Indian rupees and landed in business bank accounts abroad.

“What they did was complex and specialised and needed various cover stories,” Blackburn said.

He said Harish had a legitimate job in his family business, Alpha Electrics Ltd, run with his brothers who were completely unaware of the alleged scam.

The company was involved in selling, renovating and repairing electrical items, the report added. Blackburn claimed Harish set up another company Alpha Diam Ltd, which neither bought or sold any diamonds or jewellery. It was allegedly used as a “vehicle” for money laundering, backed up with bogus invoices of non-existent diamond trading to account for the criminal cash he was handling on behalf of unknown others. Ravindra, who allegedly delivered the money to banks, in particular to the Bank of Baroda in Belgrave Road, claimed he was innocently involved. Blackburn said various banking outlets and institutions were used as more than 200,000 pounds was transferred out of the UK each week.

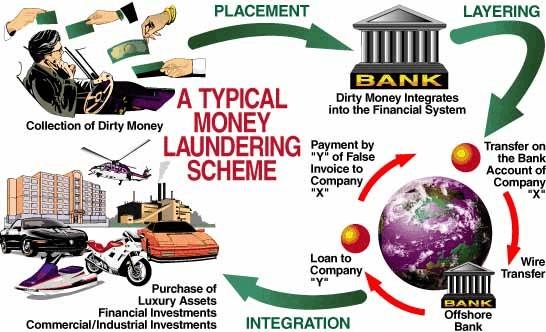

What is money laundering?

Money earned through criminal activities is said to be “dirty”. For this reason, criminals whose main goal is to profit from their criminal acts, have to “cleanse” such money of its illicit origin. In order to enjoy their ill-gotten gains, criminals commonly seek to disguise the illegal source of their profits. Money laundering is the term applied to the act of concealing the origins of such money and releasing it undetected into legitimate business activities, the purpose being to prevent it from being tracked and confiscated by the government. Money laundering is most commonly associated with criminal activities such as drug trafficking, corruption, kidnapping, extortion, tax evasion, trafficking people and a range of other criminal activities.