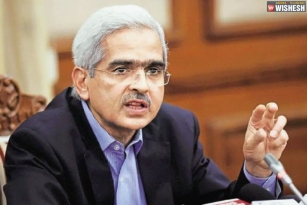

The Reserve Bank of India (RBI) today said that "it will remove curbs on daily cash withdrawals from ATMs from Wednesday, February 1."

It has also lifted the restrictions on withdrawal limit from current accounts, cash credit accounts and overdraft accounts.

"Limits on withdrawing cash from savings bank accounts would, however, continue for now and are under consideration for withdrawal in the near future," the central bank said.

All those holding savings accounts will no longer be limited to withdrawing only 10,000 rupees in a single transaction from ATMs. One can withdraw Rs. 24,000 at one go, but as curbs on savings accounts haven't been lifted yet, they cannot withdraw any more money throughout the week.

The RBI today said "it was allowing banks to use their "discretion" in placing their own daily cash withdrawal limits at ATMs, as was the case before November 8."

The RBI chief Urjit Patel earlier this month told a parliamentary panel that "the central bank has issued Rs. 9.2 lakh crore of a new currency, thus replacing 60 percent of demonetised currency. The RBI had initially set a cash withdrawal limit of Rs. 50,000 from current accounts which were later increased to Rs. 100,000 a day."

RBI Increases Daily Withdrawal Limit to Rs.10,000

BY M. DIVYA SRI