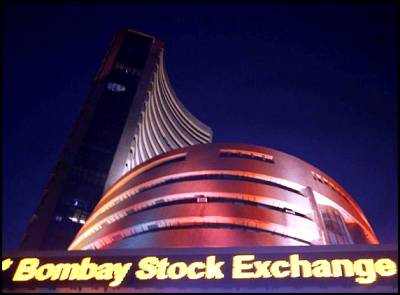

On Friday, declining for the sixth day in a row, the BSE benchmark Sensex hit fresh four months low by losing over 57 points as cautious investors abstained from an impulse of buying on current political worries amid weak global cues.

To move ahead...

The Sensex remained explosive before ending with a loss of 57.27 points, or 0.30 per cent, to 18,735.60, the levels last seen on November 26, 2012. In fact, the index had lost 778 points in last five sessions while the gauge shuttled between 18,859.82 and 18,669.20 during the session.

Likewise, the broad-based National Stock Exchange index Nifty declined 7.40 points, or 0.13 per cent, to 5,651.35, after moving between 5,691.45 and 5,631.80.

According to the Brokers, investors turned extremely cautious on concern that political instability after the withdrawal of support by the DMK to the ruling UPA government and limited room to cut interest rates might undermine efforts to revive economic growth.

They also expressed that a weakening Asian trend and lower opening in Europe as Cypriot lawmakers begin a debate to unlock bailout funds and prevent a financial collapse, further influenced the market sentiment.

Fact-fully, in 30-BSE index components, 18 stocks declined led by State Bank of India, ICICI Bank, Infosys, Reliance Industries, Bharti Airtel, Dr Reddy’s Lab, Tata Motors and Tata Steel. Nearly half of the benchmark kitty stocks lost over five per cent this week, while the small and medium six sector stocks suffered heavy losses on all-round selling.

In fact, the consumer durable sector index suffered the most by losing 2.06 per cent to 6,825.22 followed by realty sector by 1.31 per cent to 1,781.36. IT index fell by 0.82 per cent to 6,787.91 and oil and gas sector by 0.54 per cent to 8,422.26.

Nevertheless, a gain in stocks of Bajaj Auto, Hero MotoCorp, Hindalco, Sterlite Industries, Jindal Steel and Tata Power saved the market from any possible circumstance.

(AW:Samrat Biswas)